Gold Price Forecast: Asian traders test bullish commitments

- Gold is stuck in a familiar range but risks this week could shift prices.

- Central banks and covid fears are on the cards and US data will continue to pour in.

The price of gold has been trading in familiar ranges since mid-July and early August and attempts to break the $1,830s have failed on two occasions, so far.

The market this week has seen gold better offered and in Asia on Tuesday, the price of the yellow metal has been pushed to a low of $1,809.52.

The highest level reached, so far, has been $1,813.98 but the US dollar is climbing out of the dumps, at least it is attempting to do so following a negative day on Wall Street.

The US yield dropped on Monday shortly after an Institute for Supply Management (ISM) report showed July US Manufacturing growth slowed for the second straight month at 59.5 vs exp: 61.0, prev: 60.6.

While the reading of 59.5 manufacturing ISM is still a strong number, traders are positioning for a potential slowdown in growth.

China, the prior day, reported the July Caixin Manufacturing PMI that fells to a 15-month low of 50.3 from 51.3.

The coronavirus, while not directly linked to the data, is a concern going forward and in the United States, COVID hospitalisations in Louisiana and Florida have surged to their highest points of the pandemic.

This suggests that another lockdown in the nation could be brewing, although the country's top health expert, Anthony Fauci, so far, has ruled it.

Nevertheless, the risks have outweighed any excitement over a $1 trillion infrastructure investment bill that could be ready for a final vote as early as this week.

Moreover, the Delta variant, which US authorities on Monday described as contagious as chickenpox and far more contagious than the common cold or flu, is raging in many Asian countries.

Should this gather traction over coming weeks, the Jackson Hole may not be the event that some had speculated it to be, where the Federal reserve may have used it to announce a taper timing.

Nevertheless, the US dollar has historically done well at times of high risk-off markets and the US dollar smile theory could be in play for the foreseeable future, as a headwind to gold prices.

The immediate risk for the US dollar will be in central banks, the Reserve Bank of Australia, and the UK's Bank of England.

Traders will garner close scrutiny in G10 with doves and hawks squaring up over the impact of extended lockdowns/downside growth risks to Australia and rising price wage inflation in the UK.

Also, Wednesday's Servies and Friday's Nonfarm Payrolls data will be critical with a special emphasis on both considering the Fed's chair's keen eye on economic data.

The US dollar could find a bid in any of or all of the above as a headwind for gold.

''Nonetheless, with the FOMC risk in the rearview, the gravitational pull of record low real rates is offering support to the precious metals in the immediate term,'' analysts at TD Securities said.

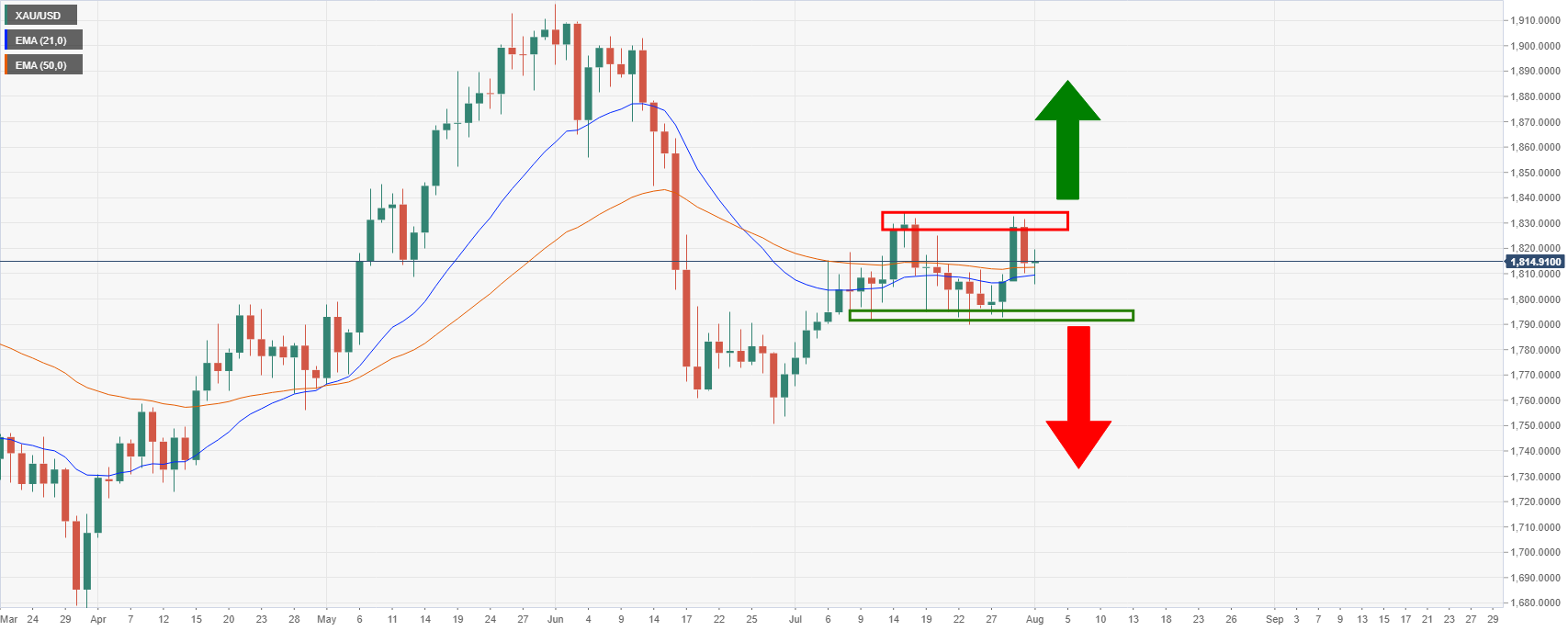

Gold technical analysis

From a daily perspective, gold hovers around critical 21 and 50 EMA convergence and between support and resistance.

A break of either side would be a significant development.