Back

16 Mar 2020

USD/INR New York Price Analysis: Dollar off three-decades highs near 74.00 figure post-Fed’s cut

- USD/INR uptrend remains intact as the quote is trading off three-decades highs.

- A deeper pullback down cannot be ruled out.

- The Fed cut interest rates by 100bps to 0%.

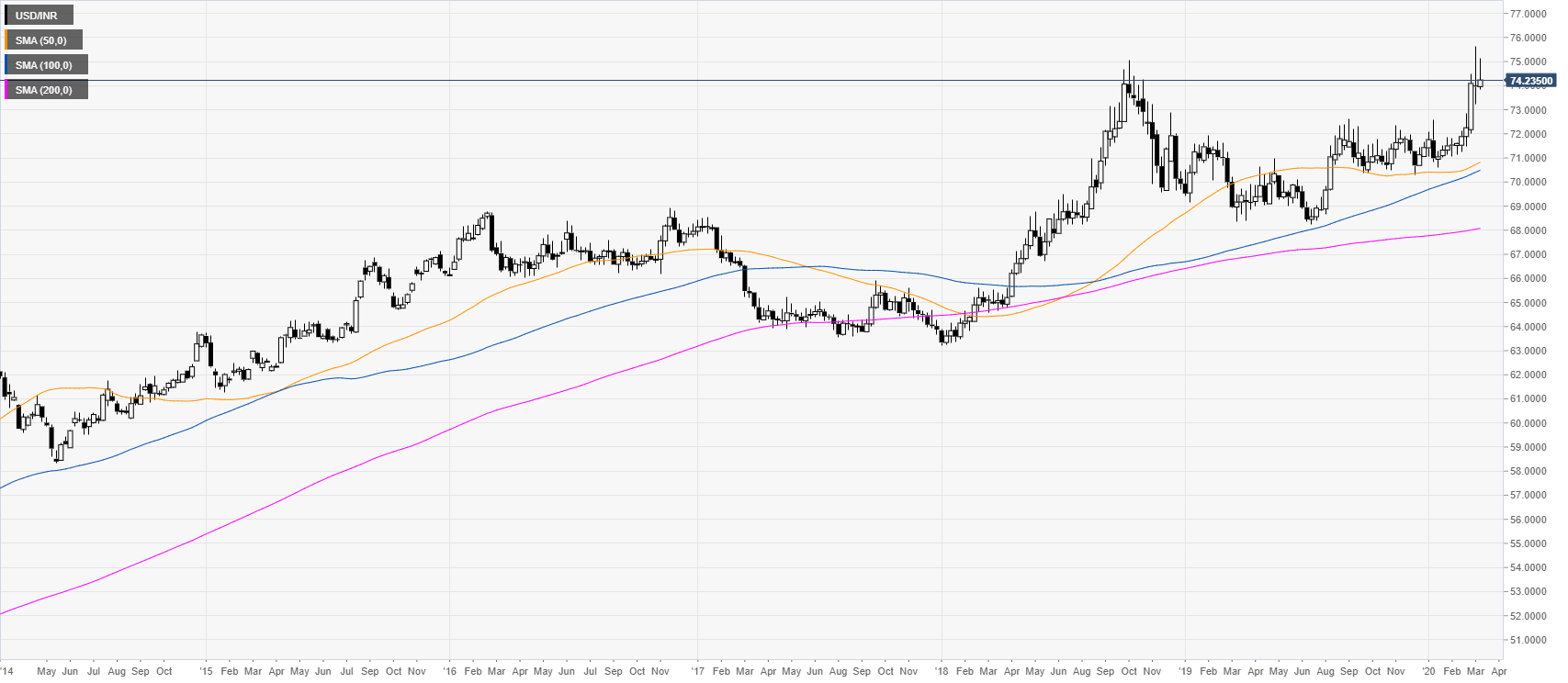

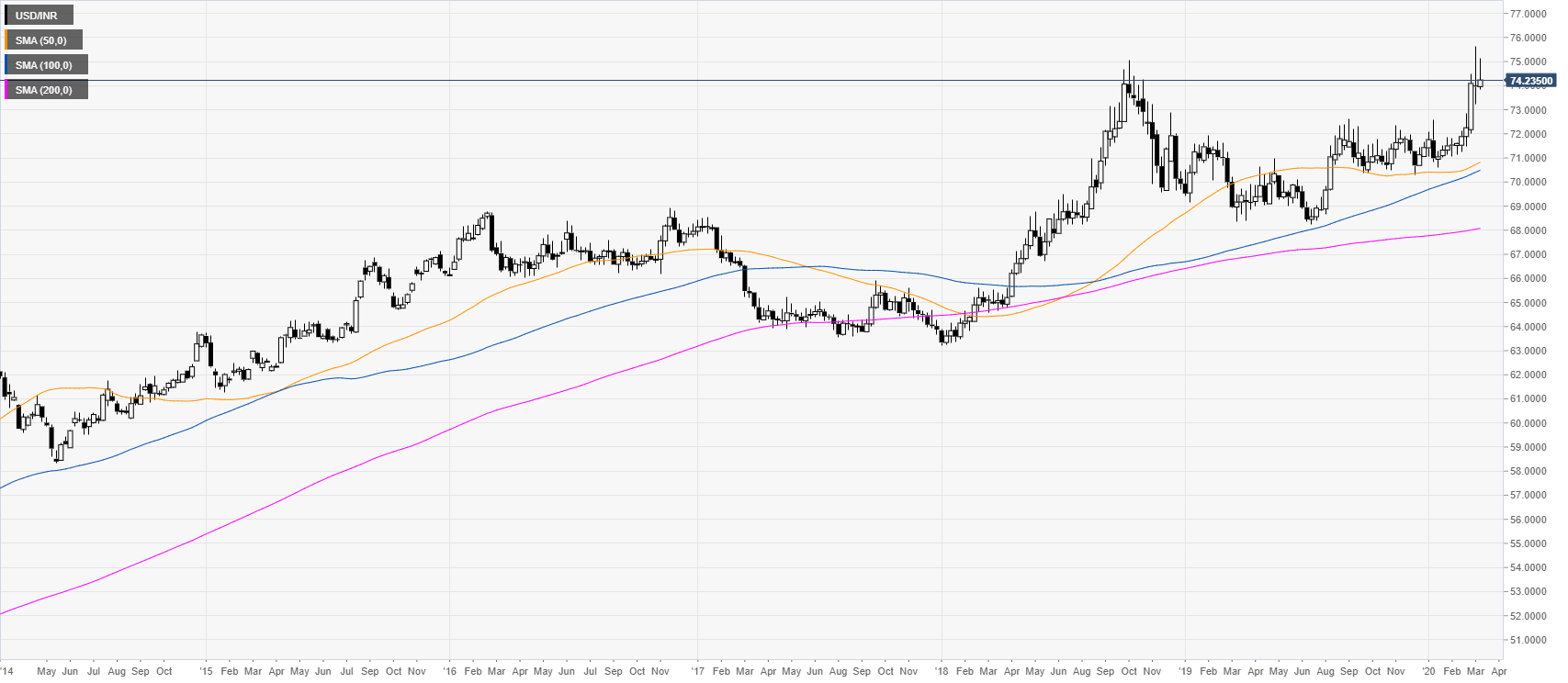

USD/INR weekly chart

USD/INR is trading above its main weekly simple moving averages (SMAs) while trading near h three-decade highs just above the 74.00 figure. To respond to the coronaivurs crises, the Federal Reserves cut interest rates by surprise by 100bps to 0%.

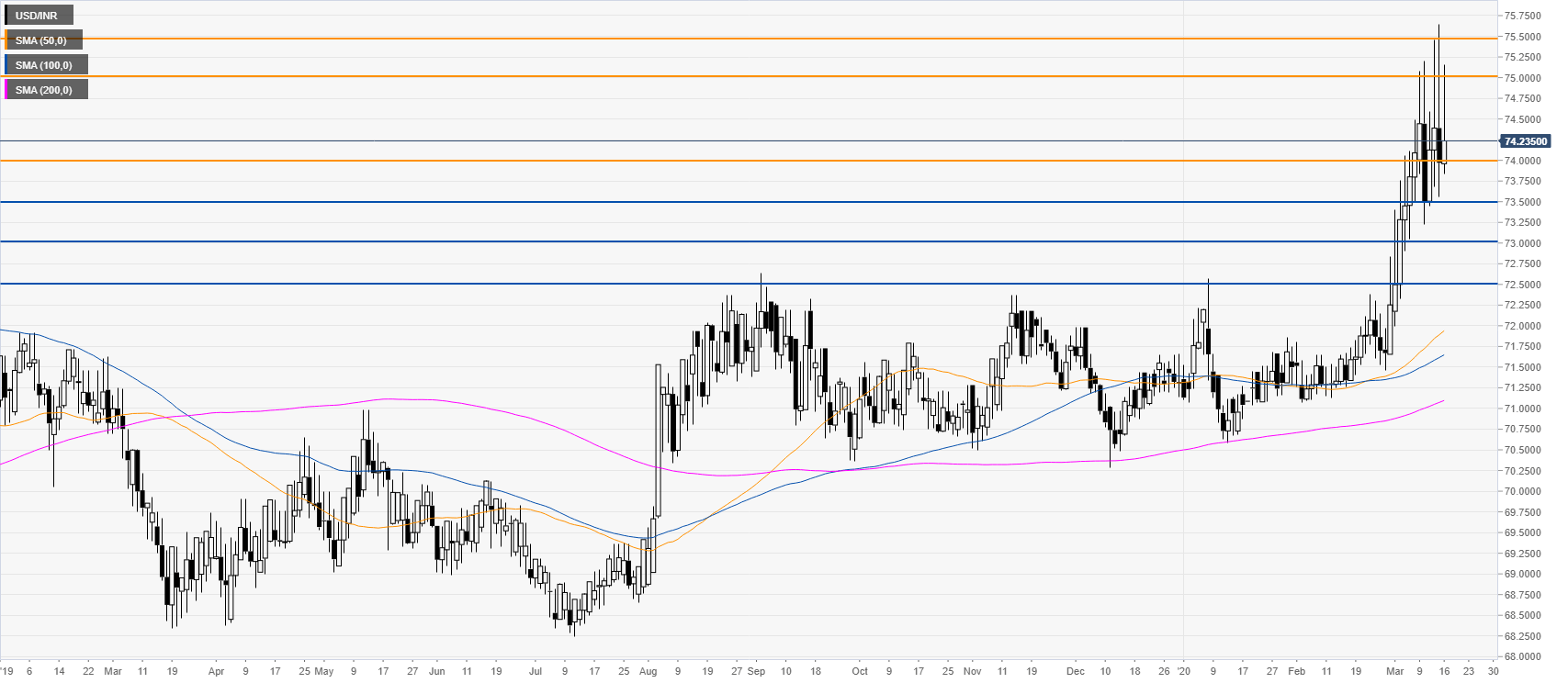

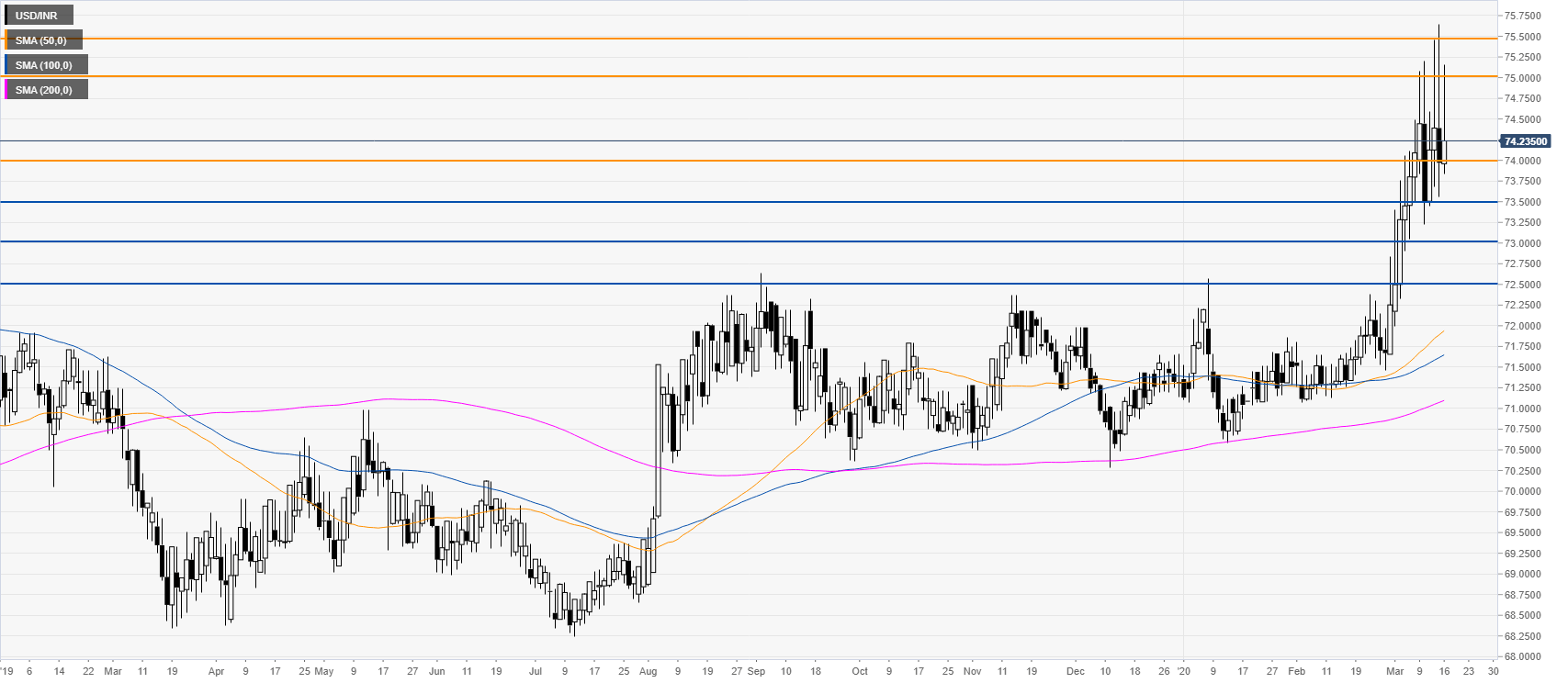

USD/INR daily chart

The spot is currently fading the 75.00 figure while challenging the 74.00 level. A daily close below the 73.50 level might lead to a deeper retracement down towards 73.00 and 72.50 levels. Buyers would need to recapture the 75.50 resistance in order to travel into uncharted territories.

Additional key levels