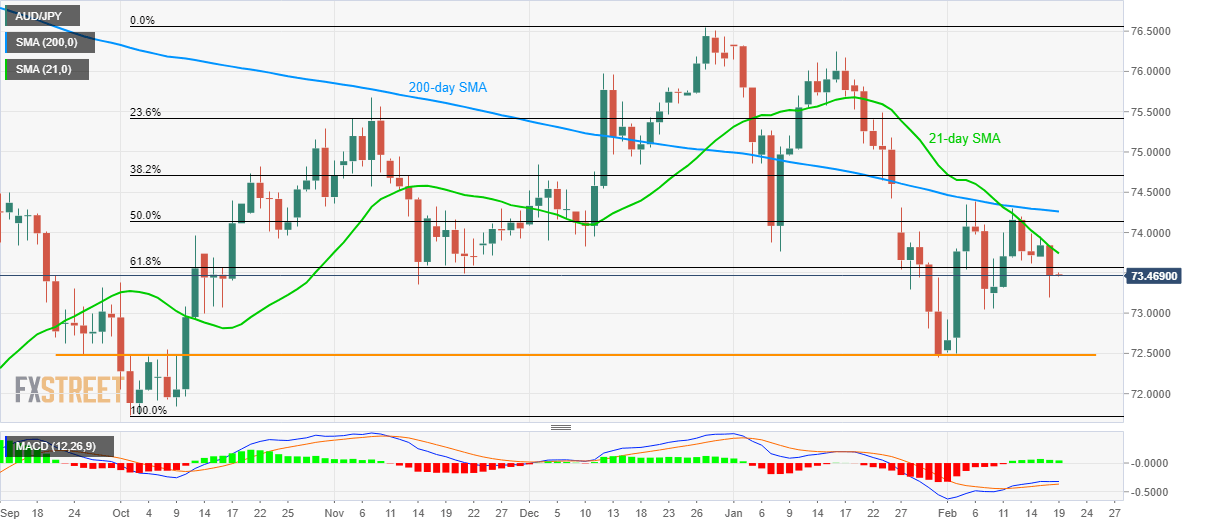

AUD/JPY Price Analysis: Under pressure below 61.8% Fibonacci, 21-day SMA

- AUD/JPY stays on the back foot after testing the lowest in seven days.

- 50% Fibonacci retracement and 200-day SMA add to the upside barriers.

- The yearly bottom gains the bears’ attention.

AUD/JPY declines to 73.47 during the early Asian session on Wednesday. The pair recently slipped below 61.8% Fibonacci retracement of its October-December 2019 upside while staying under 21-day SMA.

That said, the pair is currently targeting February 07 low, near 73.00 despite bullish MACD signals.

However, horizontal support comprising multiple levels since late-September 2019, around 72.50, will challenge the bears, if not then the return of October 2019 low of 71.74 can’t be ruled out.

In a case of the pair’s bounce beyond the immediate resistances, namely 61.8% Fibonacci retracement level of 73.57 and 21-day SMA near 73.75, AUD/JPY prices could aim for 74.15 level comprising 50% Fibonacci retracement.

Though, buyers will wait for entry until the quote manages to remain strong beyond the 200-day SMA level of 74.25.

AUD/JPY daily chart

Trend: Bearish