Gold Price Analysis: Snaps four-day winning streak, eyes on 200-bar SMA

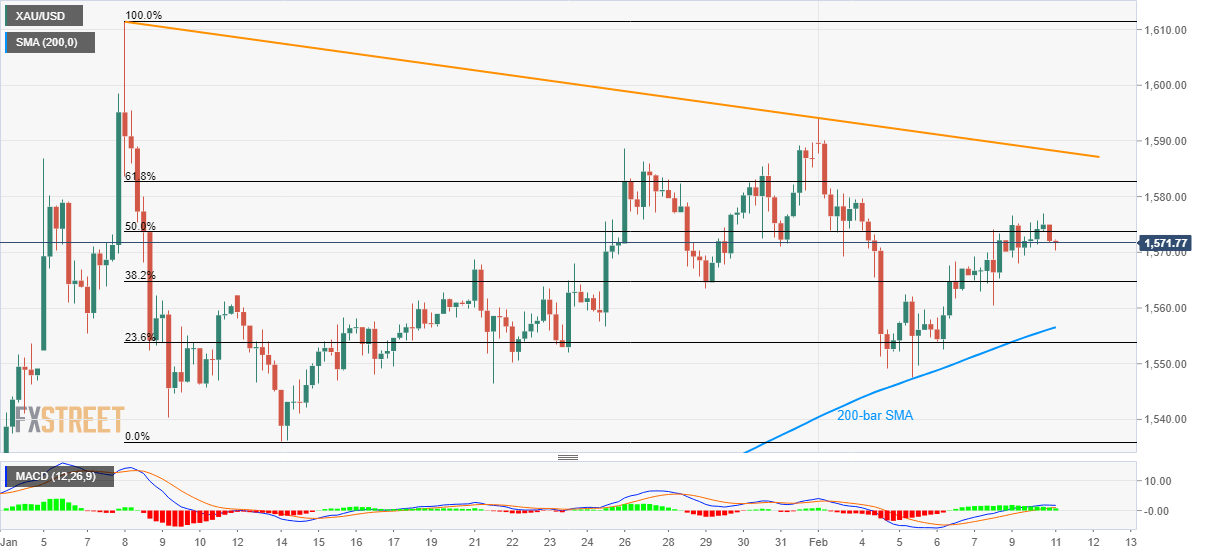

- Gold prices again fail to sustain a break beyond 50% Fibonacci retracement.

- 61.8% Fibonacci retracement, monthly resistance line add to the resistance.

- 200-bar SMA offers strong support amid bullish MACD.

Gold prices decline to the intra-day low of $1,570.35 by the press time of early Tuesday. While repeated failures to hold the break of 50% Fibonacci retracement of early-January portrays the bullion’s weakness, bullish MACD and sustained trading above 200-bar SMA check the sellers.

That said, the precious metal is currently extending the pullback towards a 38.2% Fibonacci retracement level of $1,565 before visiting a 200-bar SMA level of $1,556.50.

However, the quote’s further declines past the key SMA will make it vulnerable to challenge the monthly low surrounding $1,548.

On the contrary, 61.8% Fibonacci retracement level of $1,583 add barriers to the metal’s rise beyond $1,573 immediate resistance comprising 50% of Fibonacci retracement.

It’s worth mentioning that a downward sloping trend line since January 08, currently at $1,588, holds the key to a run-up towards $1,600.

Gold four-hour chart

Trend: Bullish