En iyi spreadlerimiz ve koşullarımız

Platform hakkında

Platform hakkında

Crude oil West Texas Intermediate benchmark is trading at around 68.19 up 0.19% on Thursday as the market is undecided on the Iranian deal outcome.

The Iranian deal, which forces Iran to limit its nuclear program in exchange for the suspension of economic sanctions might be at risk on May 12 as Trump repeatedly said he is not willing to renew it. Trump wants to create a harsher version of the deal going against France, Germany and UK’s approval.

French President Macro went to Washington this week to discuss the issue with US President Trump, but the US President still seems decided to pull out of the deal. "My view, I don't know what your President will decide, is that he will get rid of this deal on his own, for domestic reasons," said Macron.

On the other hand, Iran said it will not accept a different version of the current deal and if any changes are made to it Iran threatens to resume its nuclear activity.

Oil markets are strongly underestimating what would be the impact of the US not renewing the Iranian deal on May 12, according to Ehsan Khoman, head of research at MUFG. The Iranian oil disruption can lead to a supply squeeze of about 350,000 barrels a day and the market might not have priced that in. If anything unexpected happens with the Iranian deal the analyst sees WTI crude oil above $75 a barrel.

"High geopolitical tensions between the U.S. and Iran certainly don't bode well for oil markets. Our base-case scenario is that Donald Trump will not sign the nuclear waiver agreement on May 12. He has been articulating that in tweeting policy and through other statements." according to Ehsan Khoman.

Meanwhile, on Thursday, two major oil companies reported their earnings for the first quarter of 2018 which showed a strong increase stemming from higher oil and gas prices. Shell reported a 42% increase in profits at $5.322 billion while, French oil major, Total, also reported above-consensus first-quarter earnings with net adjusted profit of $2.9 billion versus $2.77 billion expected by analysts.

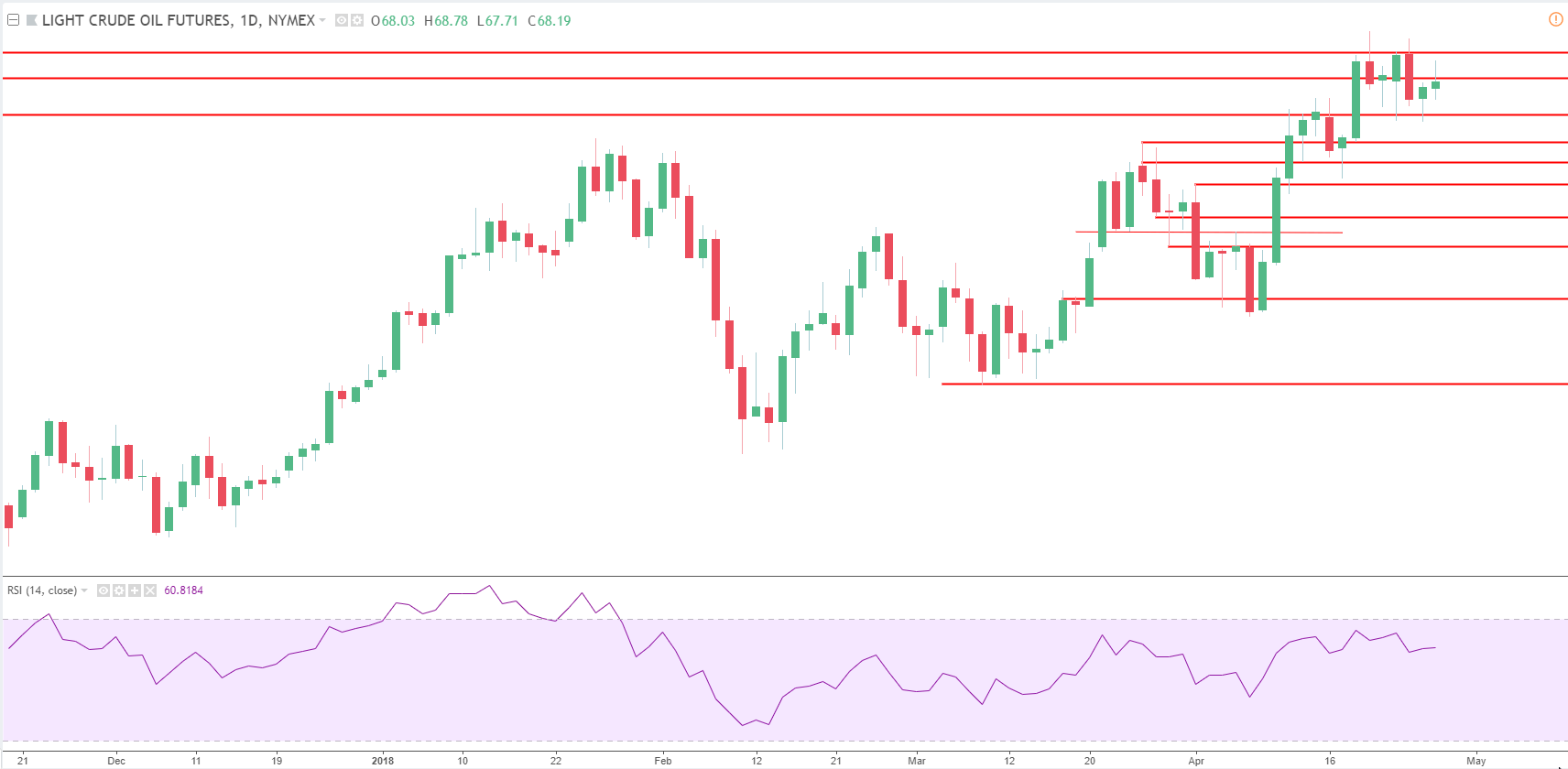

Crude oil WTI daily chart

The trend is bullish. Supports are seen at 67.30 demand level and 66.55 swing high while resistances are seen at 68.30 pivot level and the 69 figure.