USD/JPY softens amid rising US yields, global economic concerns

- USD/JPY hits YTD highs of 145.56 but trades softer at 146.12, marking a 0.15% decline.

- Economic concerns in China, including a slowdown in consumption, property market troubles, and shadow banking issues, weigh on global sentiment.

- US Initial Jobless Claims are slightly better than expected, while the Philadelphia Fed Manufacturing Index shows improvement.

USD/JPY trades with a softer tone after hitting year-to-date (YTD) highs of 145.56 amid UST bond yields climbing as investors speculate further tightening by the US Federal Reserve (Fed) lies ahead. Global bond yields advanced, but the greenback failed to gain traction. The USD/JPY is trading at 146.12, with losses of 0.15%.

Japanese Yen recovers as investors speculate on the Fed's next moves and China's economic slowdown

The Japanese Yen (JPY) is recovering ground amid risk-aversion, spurred by investors expecting the Fed could skip from hiking rates in September. Still, chances for additional tightening in November increased compared to a week ago, as shown by the CME FedWatch Tool, with odds at 34.6%, above last week’s 27.8%.

The latest Fed minutes showed the board members unanimously raised rates, despite voices becoming more neutral and worried about pushing rates too far, even though most policymakers still see upside inflation risks. Yet officials are taking a cautious approach to setting monetary policy, as they emphasized they would consider the “totality” of data to “help clarify the extent to which the disinflation process was continuing.”

Another reason that boosted the JPY is the ongoing economic deceleration in China. Recent data from the second-largest economy showed that consumption is slowing down, its exports are taking a hit, and trouble In the property market spurred outflows from Chinese equities. Additionally, China’s shadow bank’s $3 trillion turmoil continues to weigh on its economy.

Aside from this, the US Department of Labor (DoL) revealed the last week’s Initial Jobless Claims, which came at 239K below estimates of 240K. At the same, the Philadelphia Fed Manufacturing Index for August improved, with numbers hitting 12, exceeding the -10 contraction expected by analysts.

The Japanese docket showed that exports fell for the first time since 2021, sparking economic worries. Exports fell -0.3% in July YoY, above s forecast for a -0.8% plunge, but trailed June’s 1.5% rise. USD/JPY focus shifts towards releasing inflation data, with the Consumer Price Index (CPI) for July expected at 2.5% and core CPI at 3.1%.

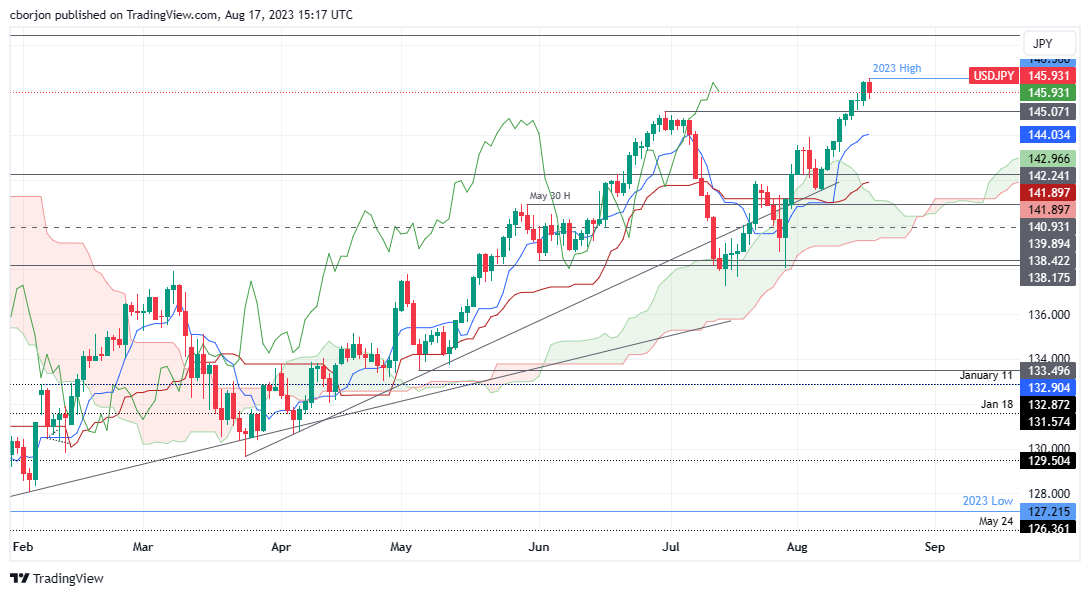

USD/JPY Price Analysis: Technical outlook

After reaching YTD highs, the USD/JPY retraced somewhat, towards the 146.00 mark, but remained above the latter, keeping buyers hopeful of higher prices. If USD/JPY achieves a daily close below 146.00, that will trigger a correction, with the June 30 inflection high turned support at 145.07, ahead of the figure. Up next, the Tenkan-Sen emerges as the next support at 144.03. Conversely, if USD/JPY stays bullish, the 147.00 mark would be next, followed by the November 3 daily high at 148.45.