USD/JPY retreats from four-week high amid BoJ intervention, US data

- USD/JPY reached a four-week high of 143.88 amid BoJ’s unscheduled bond-buying intervention.

- Initial unemployment claims came within estimates at 227K, and while ISM business services activity remains in expansionary territory, a reading of 52.7 indicates a cooling down.

- Upcoming US Nonfarm Payrolls data for July could give additional direction to the USD/JPY pair.

USD/JPY retraces after hitting a four-week high at 143.88 after the Bank of Japan (BoJ) stepped in to buy Japanese Government Bunds (JGBs) following its tweaking of the Yield Curve Control (YCC). Nevertheless, buyers’ hopes were short-lived as overall Japanese Yen (JPY) strength weighed on the USD/JPY pair. The USD/JPY exchanges hands at around 142.40s, below its opening price by approximately 0.60% in the mid-North American session.

The pair drops below its opening price by approximately 0.60%, as the Bank of Japan’s unexpected bond-buying action and mixed US economic data

Investors’ sentiment remains sour, as witnessed by US equities tumbling. US Treasury bond yields rise sharply, particularly the 10-year benchmark note, at 4.183%, gaining almost ten basis points, but cannot underpin the USD/JPY, as the JPY remains solid. US economic data revealed earlier showed that unemployment claims came within estimates of 227K, reported the US Department of Labor. Although the data is encouraging the labor market is easing, mixed reports in the last few months keep market participants unable to time when the jobs market would cool down.

The Institute for Supply Management (ISM) recently revealed that business services activity remains at expansionary territory at 52.7, below forecasts of 53, and trailed June’s 53.9. Even though data remains positive, it shows that activity is cooling down, putting on the table a recessionary scenario if consumers don’t support the economy.

Aside from this data, Friday’s US Nonfarm Payrolls report for July is expected to deliver a clear reading of the labor market. Any upward surprises could put on the table additional rate hikes by the US Federal Reserve (Fed). Otherwise, the Fed could take a cautious approach ahead of the September monetary policy meeting.

In the meantime, Richmond’s Fed President Thomas Barkin crossed the wires, said that inflation is too high, and that “ last month’s inflation read was a good one, and I hope it is a sign.”

On the Japanese front, the BoJ held an unscheduled bond-buying operation, as the 10-year JGB hit a high of 0.66% when the BoJ stepped into the market to buy JPY 400 billion across different maturities. Hence, Japanese Yen traders must be aware of this news, as volatility increases during the Asian session.

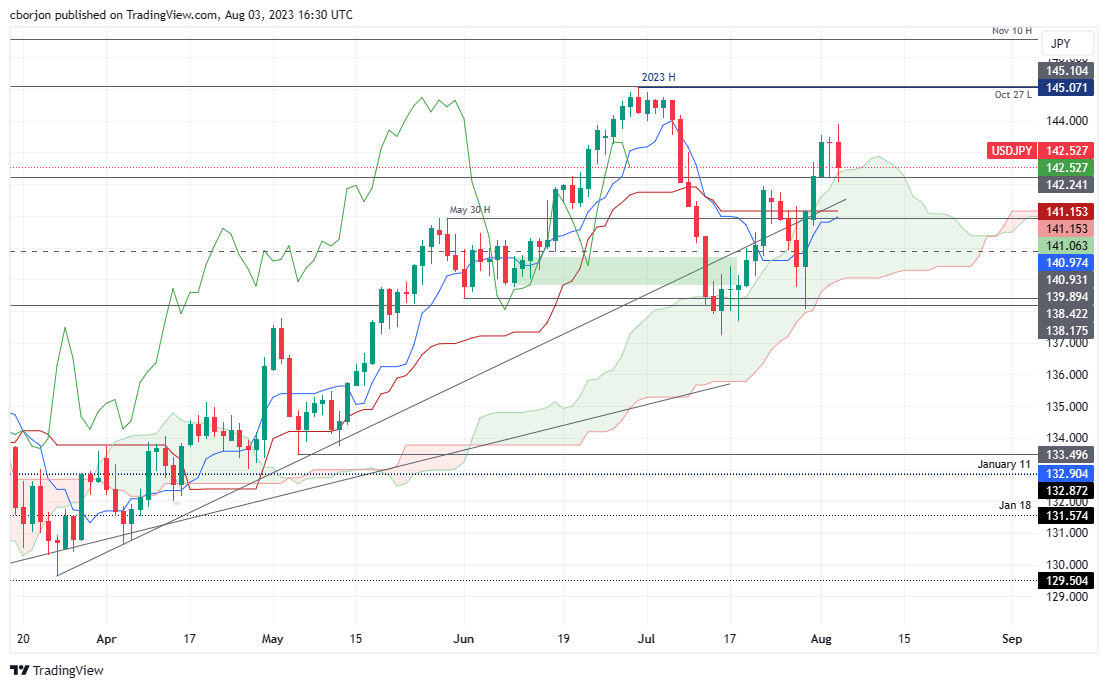

USD/JPY Price Analysis: Technical outlook

The USD/JPY remains upward biased but drifts toward the top of the Ichimoku Cloud (Kumo), a support area at around 142.35/45. If USD/JPY falls inside the Kumo, that could pave the way for further losses, with support levels found at the Kijun and Tenkan-Sen levels, each at 141.15 and 140.97. Conversely, if buyers reclaim 143.00, that could open the door to testing the weekly high of 143.88.